MOTION DYNAMICS AND PRECISION PIVOTS

EMERGINGMARKETPIVOTS.COM IS A DIVISION OF PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP. FIND MDPP PRECISION PIVOTS REAL-TIME MODEL ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, ANALYSIS, AND COMMENTARY FOR SPYPIVOTS.COM AT echovectorvest.blogspot.com. See also seekingalpha.com/author/kevin-wilbur/ins...

EchoVectorVEST MDPP PRECISION PIVOTS

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP: INCLUDING MOTION DYNAMICS AND PRECISION PIVOTS MODEL ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, ANALYSIS, AND COMMENTARY IN REAL-TIME. See Also Related Websites and Blogsites dowpivots.com, spypivots.com, goldpivots.com, oilpivots.com, bondpivots.com, dollarpivots.com, currencypivots.com, commoditypivots.com, emergingmarketpivots.com.

EchoVectorVEST MDPP, PRECISION PIVOTS

Providing Forecasting and Trade Management Technology, Analysis, and Education Consistent With More Than Doubling the Portfolio Position Value of The Major Market (Dow 30 Industrials, DIA ETF) From Mid-2007 to Early 2009!... More Than Doubling Again from Early 2009 through 2010!... Then More Than Doubling Again in 2011!... And Then More Than Tripling Again in 2012!... "Staying ahead of the curve, we're keeping watch for you!"

View my complete profile

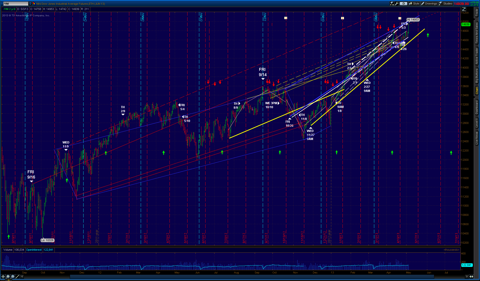

FXI ETF CHART WITH KEY AEVS (ANNUAL ECHOVECTORS) AND COORDINATE AEV FEVS (FORECAST ECHOVECTORS) FROM SELECT EBTPS (ECHOBACKTIMEPOINTS)

PRECISION PIVOTS ECHOVECTOR MDPP MODEL OUTPUT CHART ILLUSTRATION AND HIGHLIGHTS COLOR CODE GUIDE

1. Regime Change Cycle EchoVector (8 Year, Week-to-Week): Long AquaBlue

2. Regime Change Cycle EchoVector (8 Year, Week-to-Week): Long Yellow

3. Regime Change Cycle EchoVector (8 Year, Week-to-Week): Long Pink

4. Presidential Cycle EchoVector (4 Year, Day-to-Day): Long White

5. Congressional Cycle EchoVector (2 Year, Day-to-Day): Green

6. Congressional Cycle EchoVector (2 Year, Day-to-Day): Blue Purple

7. Congressional Cycle EchoVector (2 Year, Day-to-Day): Long Pink

8. Annual Cycle EchoVector (1 Year, Day-to-Day): Red

9. Annual Cycle EchoVector (1 Year, Day-to-Day): Pink

10. Annual Cycle EchoVector (1 Year, Day-to-Day): Long Blue Purple (Pivot Indicative)

11. 9-Month Cycle EchoVector (9 Months, Day-to-Day): Grey

12. Bi-Quarterly Cycle EchoVector (6 Months, Day-to-Day): Yellow

13. Quarterly Cycle EchoVector (3 Months, Day-to-Day): White

14. Monthly Cycle EchoVector (1 Month, Day-to-Day): Peach

15. Weekly Cycle EchoVector (1 Week, Day-to-Day): Aqua Blue

16. Daily Cycle EchoVector (1 Day, Day-to-Day): Short Pink

17. Select Support or Resistance Vectors and/or Relative Price Extension Vectors (Various Lengths): Navy Blue

Space-Color Vector Highlights are Graphical Illustrations of Corresponding and Coordinate Color-

Length-Slope MDPP Forecast Model Key Active Focus EchoVectors.

(Click on charts to enlarge and click on charts again to open new tab then click on charts in new tab to zoom)

ECHOVECTORVEST MDPP PRECISION PIVOTS MODEL LOGICS:

Trend period echovector echo-period price point level.

Trend period echovector echo-period price point level pivot extension: equal.

Trend period echovector echo-period price point level pivot extension: stronger: potential echovector slope pivoting effect.

Trend period echovector echo-period price point level pivot extension: weaker: potential echovector slope pivoting effect.

Trend period echovector echo-period price point level REVERSAL: Counter-Echo Pattern: Trend period echovector slope pivoting.

EP: EchoPivot: Trend Timing and Price Vector and Period Corresponding Pivot.

EPCP: EchoPivot CounterPivotPivot: Trend Timing and Price Vector and Period CounterTrend Corresponding CounterPivot (Induces greater force-slope up, or weaker force-slope up, or greater force-slope down, or weaker force-slope down).

Click to enlarge and right click to open in new tab and click again to further zoom.

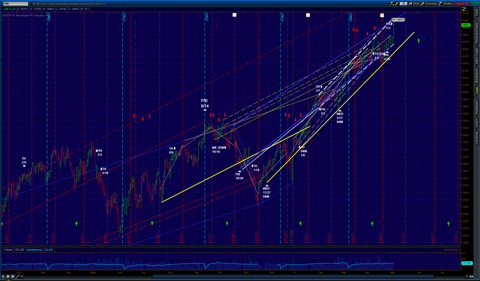

/YM DOW FUTURES 2-YEAR DAILY OHLC

/YM DOW FUTURES 15-MONTH DAILY OHLC

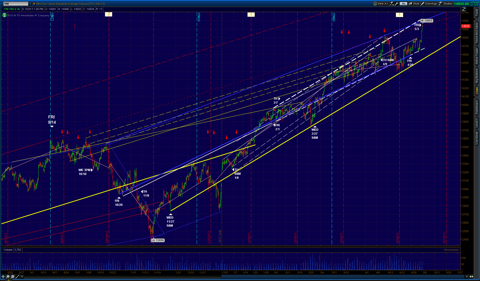

/YM DOW FUTURES 200-DAY 4-HOUR OHLC

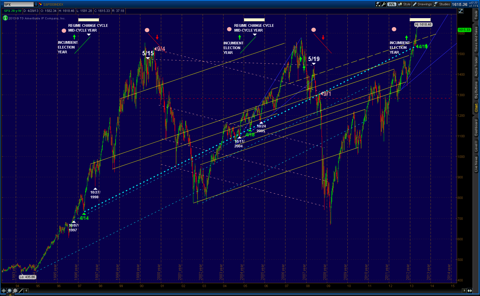

SPX 18-YEAR WEEKLY OHLC

______________________________________________________________________________

DOW 30 INDUSTRIALS /YM FUTURES CHART: THURSDAY 2 MAY 2013 1155AM WITH KEY MEV (MONTHLY ECHOVECTOR) AND COORDINATE MEV FEVS (FORECAST ECHOVECTORS) AND KEY EBDS (ECHOBACKDATES)

May 2, 2013 12:08 PM | about stocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG, DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL, IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV, TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO

EchoVectorVEST

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP: INCLUDING MOTION DYNAMICS AND PRECISION PIVOTS MODEL ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, ANALYSIS, AND COMMENTARY IN REAL-TIME. See Also Related Websites and Blogsites dowpivots.com, spypivots.com, goldpivots.com, oilpivots.com, bondpivots.com, dollarpivots.com, currencypivots.com, commoditypivots.com, emergingmarketpivots.com, and seekingalpha.com/author/kevin-wilbur/instablog/tag/echovectorvest

ProtectVest and AdvanceVEST By EchoVectorVEST MDPP

Providing Forecasting and Trade Management Technology, Analysis, and Education Consistent With More Than Doubling the Portfolio Position Value of The Major Market(Dow 30 Industrials, DIA ETF) From Mid-2007 to Early 2009!... More Than Doubling Again from Early 2009 through 2010!... Then More Than Doubling Again in 2011!... And Then More Than Tripling Again in 2012!... "Staying ahead of the curve, we're keeping watch for you!"

DOW 30 INDUSTRIALS /YM FUTURES CHART: THURSDAY 2 MAY 2013 1155AM WITH KEY MEV (MONTHLY ECHOVECTOR) AND COORDINATE MEV FEVS (FORECAST ECHOVECTORS) AND KEY EBDS (ECHOBACKDATES) AND EBTPS (ECHOBACKTIMEPOINTS) AND ES TAPS (ECHOSWING TIME AND PRICE POINTS)/YM DOW 30 INDUSTRIALS FUTURES CHARTS

(Click to enlarge and right click to open in new tab and click again to further zoom)

MONTHLY PERSPECTIVE (1155AM EASTERN DST USA)

For additional charts with MDPP Forecast Model OutPut Highlights click on http://echovectorvest.blogspot.com

__________________________________________________

PRECISION PIVOTS ECHOVECTOR MDPP MODEL OUTPUT CHART ILLUSTRATION AND HIGHLIGHTS COLOR CODE GUIDE

1. Regime Change Cycle EchoVector (8 Year, Week-to-Week): Long AquaBlue

2. Regime Change Cycle EchoVector (8 Year, Week-to-Week): Long Yellow

3. Regime Change Cycle EchoVector (8 Year, Week-to-Week): Long Pink

4. Presidential Cycle EchoVector (4 Year, Day-to-Day): Long White

5. Congressional Cycle EchoVector (2 Year, Day-to-Day): Green

6. Congressional Cycle EchoVector (2 Year, Day-to-Day): Blue Purple

7. Congressional Cycle EchoVector (2 Year, Day-to-Day): Long Pink

8. Annual Cycle EchoVector (1 Year, Day-to-Day): Red

9. Annual Cycle EchoVector (1 Year, Day-to-Day): Pink

10. Annual Cycle EchoVector (1 Year, Day-to-Day): Long Blue Purple (Pivot Indicative)

11. 9-Month Cycle EchoVector (9 Months, Day-to-Day): Grey

12. Bi-Quarterly Cycle EchoVector (6 Months, Day-to-Day): Yellow

13. Quarterly Cycle EchoVector (3 Months, Day-to-Day): White

14. Monthly Cycle EchoVector (1 Month, Day-to-Day): Peach

15. Weekly Cycle EchoVector (1 Week, Day-to-Day): Aqua Blue

16. Daily Cycle EchoVector (1 Day, Day-to-Day): Short Pink

17. Select Support or Resistance Vectors and/or Relative Price Extension Vectors (Various Lengths): Navy Blue

Space-Color Vector Highlights are Graphical Illustrations of Corresponding and Coordinate Color-

Length-Slope MDPP Forecast Model Key Active Focus EchoVectors.

(Click on charts to enlarge and click on charts again to open new tab then click on charts in new tab to zoom)

ECHOVECTORVEST MDPP PRECISION PIVOTS MODEL LOGICS:

Trend period echovector echo-period price point level.

Trend period echovector echo-period price point level pivot extension: equal.

Trend period echovector echo-period price point level pivot extension: stronger: potential echovector slope pivoting effect.

Trend period echovector echo-period price point level pivot extension: weaker: potential echovector slope pivoting effect.

Trend period echovector echo-period price point level REVERSAL: Counter-Echo Pattern: Trend period echovector slope pivoting.

EP: EchoPivot: Trend Timing and Price Vector and Period Corresponding Pivot.

EPCP: EchoPivot CounterPivotPivot: Trend Timing and Price Vector and Period CounterTrend Corresponding CounterPivot (Induces greater force-slope up, or weaker force-slope up, or greater force-slope down, or weaker force-slope down).

__________________________________________________________

No comments:

Post a Comment